posted 08/27/10 03:03 PM | updated 08/27/10 03:03 PM

Featured Post! | Views: 0 | Comments : 0 | Politics

I-1098 is the Constitutional Unconstitutional Income Tax Initiative

Save and Share this article

Tags: I-1098, income tax, sightline, excise, property, sales, phil talmadge, bill gates, hugh spitzer

advertisement

Hello!

The SunBreak is an online magazine of news & culture. It's a conversation about all the things on Seattle's mind (more about us). Got a post for us? We'd like to see it. Or just send us . If you'd like to contribute regularly, .

Twitter: @thesunbreak | Facebook

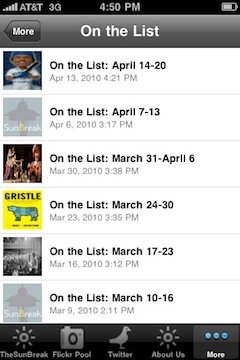

iPhone app download (Free!)

Twitter: @thesunbreak | Facebook

iPhone app download (Free!)

advertisement

Subscribe to The SunBreak

Regular reader? Subscribe to The SunBreak for just $1 per month, and help keep the news & culture coming.

Delivery Options

Subscribe to our Front Page Stories

Subscribe to our Front Page Stories

Delivery Options

![]() Subscribe to all SunBreak Stories

Subscribe to all SunBreak Stories

Daily Email Digest of The SunBreak

advertisement

Recently in Our Flickr Photo Pool

www.flickr.com

|

Our Facebook Fan Page

Neighborhood Blog News

Niche Blog News

Seattle Weather

Get the SunBreak iPhone App

Download the SunBreak iPhone app for free.

Not a Member?

Sign Up

Most Recent Comments