About this time last year, information design avatar Edward Tufte looked over the new Windows Phone 7 user interface and did not approve.

The layout and typography reminded him of posters, he said, wrong for a mobile format. Why were the home screen tiles arranged to leave black gutters top and right? (For one-handed use, it's suggested, but I don't think Tufte had ever picked up an actual WP7 phone.)

Tufte also lit into the core design principle: "The way to reduce clutter is not to thin down and sprawl out the content; instead fix the design," he wrote, noting as an aside, "Of course Microsoft's customers are already familiar with deep layerings and complex hierarchies." (Was this before Apple added folders for app-kudzu? I think so.)

So it is amusing to read this sentence in Jonathan Golob's WP7 thumbnail review on the Slog: "Metro is how Tufte would approach touch computing: Clean, crisp, without chrome, with the information itself providing the beauty." Harumph! One difference is that Golob actually used WP7 on a phone. Where Tufte scoffed at the idea of an "interface for an interface," saying it distanced users from what they wanted to do, Golob tried it out:

The UI implies the screen in your hand is a small subset of a larger plane you're navigating through with swipe gestures. It works. It's smooth. After a few days of using Metro, it's unpleasant to go back to an iPhone....

(more)

Last week the Los Angeles Times helped Boeing make cautionary case study history with its investigation of what went wrong with the aerospace manufacturer's three-years-late new plane: "787 Dreamliner teaches Boeing costly lesson on outsourcing."

Then New York Times columnist Paul Krugman picked up on the story, "Thank you, Boeing," using it as an economics lesson:

In Boeing’s case, they outsourced far too much, only to find that they were getting parts that didn’t do what they were supposed to--and also to find that the subcontractors were seizing a lot of the rents. They discovered, in effect, that there are times when it’s better to rely on central planning than to leave things up to the market.

(Krugman says he threw in the "central planning" reference as bait for Stalinist-sniffer-outers--it worked. Peruse the comment thread.)

The L.A. Times story references a talk that Boeing commercial airplanes CEO Jim Albaugh gave to Seattle University business students, titled "There Are No Shortcuts":

We gave work to people that had never really done this kind of technology before, and then we didn't provide the oversight that was necessary. In hindsight, we spent a lot more money in trying to recover than we ever would have spent if we tried to keep many of the key technologies closer to Boeing. The pendulum swung too far....

(more)

(H/t MyBallard) "With an army of bees and a determination to increase pollination in Seattle, Corky Luster is helping to stave off the drop in the honeybee population. What Luster didn’t count on: that customers would go crazy over his honey." That's the lead-in for Corky Luster's entry in the AMD Visionary of the Year Awards. He's a finalist in the Foodie category, and you can watch a video and vote for him here.

The prize is $20,000, which Corky says he'd like to use to hire interns, teach beekeeping, and grow his bee empire beyond Ballard and even Seattle, into neighboring counties.

Interns is probably step number one. It seems like every time I visit Ballard, I run into Corky. It's not that surprising--the Ballard Bee Co. has some 60 hives hidden in backyards all over Ballard, making one of Corky's days look like a very inclusive walking map of the area. "Keeping the Bee in Ballard" is the slogan.

The last two times I was in Ballard, I ran into him at Domanico Cellars and I ran into Corky on the roof of Bastille. Part of the success of the BBC, as it's known, is that you can "host" two or three hives in some out-of-the-way spot in your yard, Corky will do all the bee-looking-after, and at the end of the season, you get a 22-oz. jar of honey. (You can also try their rent-a-hive plan.)

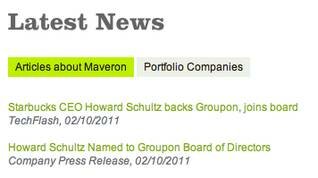

As TechFlash reports, it's Howard Schultz's investment firm Maveron, not Starbucks, that is taking a closer walk with Groupon. Shultz is interested enough to invest, and prudent enough to join the board to watch where his money goes. His move create an interesting home-team dynamic:

As TechFlash reports, it's Howard Schultz's investment firm Maveron, not Starbucks, that is taking a closer walk with Groupon. Shultz is interested enough to invest, and prudent enough to join the board to watch where his money goes. His move create an interesting home-team dynamic:

Backed by Amazon.com, LivingSocial recently featured a daily discount from the Seattle online retailer in which consumers received a $20 gift card for $10. (Could we see a similar offering from Starbucks in the future?)

The news doesn't seem to have had any effect on SBUX shares. Forbes notes that, "Private companies typically add outsiders to their boards before going public." Schultz also sits on the board of Pinkberry.

In Internet time, Groupon was previously known for its colossal misjudgment on a series of Super Bowl ads and is subject to an ongoing backlash as participants discover, sometimes belatedly, that Groupon's economics work best first and foremost for Groupon.

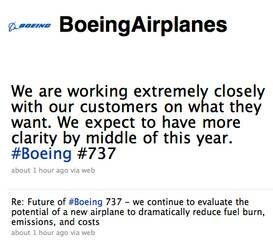

Flightglobal.com quotes Boeing CEO Jim McNerney as saying, "We're gonna do a new airplane. We're not done evaluating this whole situation yet, but our current bias is to not re-engine, is to move to an all-new airplane at the end of the decade, or the beginning of the next decade."

Flightglobal.com quotes Boeing CEO Jim McNerney as saying, "We're gonna do a new airplane. We're not done evaluating this whole situation yet, but our current bias is to not re-engine, is to move to an all-new airplane at the end of the decade, or the beginning of the next decade."

The aviation blog calls this "a rhetorical green light," but note that even rhetorically, Boeing's deadline slips. Boeing's Twitter account was far less emphatic, saying that evaluation was ongoing.

Given the difficulties with the 787 Dreamliner, the decision to build a new plane, rather than re-engine, carries a great deal more drama. This Reuters article floats the idea that Boeing is perhaps bluffing, since they have to say something about the Airbus A320neo, and it might as well be something that keeps Boeing competitors off-balance.

Said McNerney: "I feel pretty comfortable we can defend our customer base, both because they're not going ahead of us, they're catching up to us, and because we're going to be doing a new airplane that will go beyond the capability of what the neo can do."

(H/t TechFlash) I wanted to get the Bing team's take on Google calling them out for "cheating" so I clicked over to the Google search blog. (Thank you! No, we have fun.)

(H/t TechFlash) I wanted to get the Bing team's take on Google calling them out for "cheating" so I clicked over to the Google search blog. (Thank you! No, we have fun.)

I'll fit the search contretemps in a nutshell here--but you can find the whole story, including search forensics, at Danny Sullivan's Search Engine Land: "Google: Bing Is Cheating, Copying Our Search Results."

Basically, Google engineers first noticed that Bing was delivering the same results for misspelled words as Google was giving. That struck them as odd because on Bing's page, the misspelled word was still misspelled. Google has spent a lot of time and money dealing with the problem of search monkeys typing in the wrong word, so they were curious about Bing's new ESP technology.

To test their hypothesis--"Bing is reading our minds"--they constructed a number of fake search results for decidedly uncommon searches ("hiybbprqag" and "mbgrxpgjys," for example), and entered them in IE with Suggested Sites and the Bing Toolbar on. Presto! Bing started serving up Google's fake results, too.

Now, Bing would like you to know this is only possible when Google is the only source with information on these mysterious terms. (Though, as Sullivan points out, it's those rare, "out there" search successes that can make a search engine's name. If Google is the only source, that says something.) Nor are they directly spying on Google--people are using Google in IE browsers (or while using the Bing toolbar), and have "agreed" to let Microsoft observe their usage. Bing's Harry Shum, PhD, explains:...

Governor Gregoire has not had a lot of good news to report recently, so the exclamation mark after her latest tweet is probably heartfelt.

I suppose it's sexier to note the state's #5 ranking by Jim Cramer's TheStreet, but it's worth clarifying that "TheStreet is highlighting the five best and worst states for small businesses as compiled by the Small Business & Entrepreneur Council as part of its annual Small Business Survival Index, released in December." (The full index pdf is here.)

TheStreet boils the SBE survival index down for you. On the pro-business side, Washington has no "taxes for personal income, individual income, corporate income and corporate capital gains. It also boasts low electric utility costs...." On the burdensome side, we have high unemployment taxes and extremely high consumption-based taxes, and small businesses also have to cope with health insurance mandates and a high minimum wage.

They also approve of Gov. Gregoire's executive order from last October, in which she called for departments and agencies to make it easier for small businesses to do business:...

Former WaMu customers: "Formerly free checking" is the new black! Tipster Arne alerted us to the fact that if you were migrated to a Chase Total Checking account and have under $1,500 in it (or less than $5,000 across all your deposit accounts), they've begun charging a $12 per month fee. That's $144 a year for the privilege of them holding onto your money for you. I believe you can ward off the fee by making a monthly direct deposit of at least $500.

This is not restricted to JP Morgan Chase, of course. As the Motley Fool helpfully recounts in "Your Bank's Latest Fee Shakedown":

- Over at Bank of America (NYSE: BAC), you'll pay $6 to $25 a month, depending on your account balances and the kinds of accounts you have with the company.

- A basic account at Citigroup (NYSE: C) runs $8 a month if you fail to transact with the bank at least five times a month. And for a less basic account, it's $20 a month if your balance (in a single or multiple accounts) falls below $6,000.

- And at Wells Fargo (NYSE: WFC), formerly free checking now costs new customers $5 a month, plus $6.95 for online bill payment privileges....

So, yes, last week I was sitting at a large table in a banquet room at the Metropolitan Grill, savoring a hunk of bloody Wagyu, and thinking that if I had it all to do over again, stock broker is the way to go. I know, it's a cliché, but there was also an iceberg-sized iceberg lettuce salad for starters and a Meyer lemon meringue tart. So I think we got all the food groups. (The Met is strong in the grape group, too, with a string of Wine Spectator Awards of Excellence.)

The occasion was the 28th Annual Guess the Dow luncheon, which is hosted by the Met; they invite ten brokers from Morgan Stanley Smith Barney, RBC Dain Rauscher, McAdams Wright Ragen, Summit Capital (to name a few) to do much more than guess the Dow's year-end close, actually. They pick three Northwest stocks, one stand-out publicly traded stock, and prognosticate on the rate for 10-year Treasury bills. Over the past decade, with the notable exception of 2008, the group's average tracks right along with how the market performed.

The Dow picker for 2010 was Morgan Stanley's Lynn Lindsay, who had 11, 581 versus the actual 11,577. (The Met invites "civilians" to join in, too. Jennifer Noveck, a UW graduate student, won with 11,497, which she predicted back on April 1, 2010.)

Last year's overall winner was Mary Ann Heeren (RBC Dain Rauscher), whose Northwest portfolio gained almost 170 percent, so let's highlight her top three Northwest stocks: Seattle Genetics (SGEN), Starbucks (SBUX), and Boeing (BA). Nationally, she expects good things from Citigroup (C)....

Coinstar (CSTR), the parent company of Redbox, had its stock "plunge" 24 percent today, after a preliminary announcement that its Q4 earnings didn't meet expectations. Looking ahead, "Coinstar also has revised its initial outlook for full year 2011 and now expects revenue between $1.70 billion and $1.85 billion, adjusted EBITDA from continuing operations between $325 million and $355 million."

That drop is probably an overly dramatic response, considering "[r]evenue from Redbox rose 38 percent in the fourth quarter, and same-store sales (an important metric for retailers) were up 12.5 percent," as CNNMoney reported. They just didn't meet very rosy expectations: "Coinstar's biggest problem is they suck at guidance, not that their business is bad," analyst Michael Pachter told CNNMoney. Redbox currently has about 28 percent of the rental market, and I wouldn't expect that to dip much, if at all, near-term in response to streaming video access, due to the costs associated with and limitations to broadband access.

As it happens, Coinstar is a Bellevue company, and CEO Paul Davis was at the Met Grill yesterday afternoon, giving a presentation for the Met Grill's "Guess the Dow" stockbroker participants. (More on that in a later post.) Davis spoke a bit about the pressure they'd gotten from major studios not to stock new movies in Redbox's automated DVD rental kiosks the day they go on sale. Eventually, Redbox agreed to a 28-day delay, which effectively removed the 28-day advantage they had over Netflix up to that point.

As is common practice, Coinstar waited for the market to close to announce the downbeat earnings, so Davis didn't let on at his noon presentation that anything was amiss. (Other than the dog-not-barking sound of not leaking good news just before it's announced publicly.) Particularly disappointing for Redbox, since they traded rental delay for access to Blu-ray titles, was that demand for Blu-ray was not widespread, even at a $1.50 per day rate. (Redbox's standard DVD rate is $1 per day.) ...

Now they just need to figure out where to put the solar panels and windmills.

How much would it cost to string an extension cord to Oregon? Due to recent changes in the application of Oregon's residential energy tax credit, residential customers can now lease solar power for "as little as $20 per month, with no upfront cost," claims SolarCity, a national solar provider. Their news release explains:

The affordable new financing option was made possible by new rules published by the Oregon Department of Energy that went into effect on Jan. 1. The new rules allow customers who choose to lease their solar systems to receive the residential tax credit (RETC) that was previously only available to customers that purchased solar systems.

Oregon's RETC returns up to $6,000 total to residents who install solar power, a maximum of $1,500 per year over four years. SolarCity's lease plan allows customers to pay for their system installation when they receive their annual credit, rather than having to pay the full bill up front. SolarCity retains ownership of the solar panels for the 15-year lease, and receives a federal tax credit as well as a depreciating-asset write-off, says OregonLive. The panels are said to have a 30-year lifespan.

A 3.2-kilowatt system would cost about $18,000 to install on your own. With rebates and incentives, depending on where you live, you might recoup $12,000. That would still leave you with $6,000 out of your pocket. (Here's a cost breakdown on a 5kW system in Washington.) The lease program removes that hurdle; if it's not a hurdle, by the way, SolarCity will happily take cash.

The net result is something of a wash in terms of money saved; if you pay your utility $70 per month, SolarCity estimates, you might pay $30 less thanks to solar. Your lease payment would be around $25, so you save $5. (The lease is transferable to the new owner if you sell your home.) There are other benefits: You've locked in a portion of your electricity costs against rate increases, your carbon footprint is lessened, and you have a conversation-starter at the co-op.

The more important accomplishment is achieved in scale. Presently solar power adoption has a significant barrier to entry--that upfront installation cost. As RvO reported earlier:

Solar energy systems are not cheap up front. The "average" price for the installation of a 5-kW solar electric system is between $20,000 and $40,000. Seattle City Light says a 2-kW system can run $12,000 to $20,000. To make that money back through electricity bill savings and incentives might take 10 to 12 years, though that recoupment time, remarkably, is down by almost half from what it used to be....

(more)

Just over a year ago, a Boeing 787 Dreamliner took off on its maiden test flight. Without taking anything away from that accomplishment, it's sobering to note that only today has Boeing has announced 787 test flights will resume, following a month's grounding when a test plane's electrical panel caught fire.

Media have been investigating the 787 program, and the analysis shows that Boeing placed a large bet on an aggressive production timeline, discounting heavily to fill the sales pipeline. As neither the production timeline nor the test flight schedule have cooperated, Boeing finds itself in a tricky situation, reports FlightBlogger: "[T]he cost to build each 787 has skyrocketed from its original foundations built upon dramatically lower and more predictable production costs, say company insiders."

The Seattle Times' Dominic Gates wrote a major story on Boeing's precarious position, "Dreamliners' woes pile up." A sidebar is devoted to "What's wrong with the 787 Dreamliner," and Gates ventures to put a price on the debacle:...

Examples of Sunergy Systems residential installations

Examples of Sunergy Systems residential installations

NW SEED hopes to roll out the Solarize program to two more neighborhoods in 2011, so let the online lobbying begin.

Solarize Queen Anne includes a registration process to determine which Queen Anne residents are interested in learning about solar power, workshops, and free site assessment from Ballard's Sunergy Systems to see if solar power can light up your life effectively. Best case, you have a roof with tons of southern exposure, and that can handle a solar installation on top.

What makes Solarize Queen Anne different than simply asking Sunergy Systems to install a few panels on your roof is that they're leveraging community interest to make discounted bulk buys of materials. So in addition to a Federal Residential Solar Tax Credit, a Washington State Renewable Energy Production Incentive, and a Washington State sales tax exemption, participants will see bulk purchase savings.

You may have questions about solar energy in Seattle. It's a little counterintuitive, but keep in mind that while there was actual sunshine this afternoon, in mid-December, where you might really send the meter spinning backwards (not that they do, anymore, it's just an expression) is during our long summer days. And if you're among the 500 people who have been without power all day, you might really appreciate the benefits to having your own power source.

We get a lot of hyperbolic "WAR ON CHRISTMAS" ALERTS! in our email inbox this time of year, but this time it's personal. Apparently, the Fun Forest, having been given an unceremonious boot by the cash-strapped Seattle Center, was also the operator of the Christmas Carousel. As they have been asked to be out by January 2--about a month's notice--there was no time to set up the carousel this year.

Adding insult to public-spirited injury, the Center refused an offer to take ownership of the carousel, Fun Forest manager Beth McNelley told Goldy on the Slog. Admittedly, the gift was tied to a lease extension to 2012, but it seems odd that the Seattle Center, which is owed some $1.1 million in back rent by a variety of tenants, would be turning down the Fun Forest's offer of $250,000.

As of 2007, the Fun Forest themselves owed the Center over $750,000, but they negotiated a lower rent in return for a shortened lease. The Center believes it can get $350,000 per year from a new Chihuly glass exhibit, created by the owners of the Space Needle--an amount that would bump to $500,000 a year after five years. But that amount is theoretical if and until the exhibit is built and opens. The Center needs money now.

Center officials seem intent on digging their money pit even deeper, though: Despite the fact that Center House concessionaires Center House Bistro & Bar and the Bubbles Inc. candy store owe $46,865 and $28,503 (respectively, per Crosscut), the word is that they are being asked to make way for Food Court construction beginning in July, their high season.

So you're sitting at home, and you decide you want to watch something on Netflix. You've got Comcast (excuse me, Xfinity) broadband, streaming is a snap. You pay extra for that bandwidth, but it's worth it and now is one of those times.

So you're sitting at home, and you decide you want to watch something on Netflix. You've got Comcast (excuse me, Xfinity) broadband, streaming is a snap. You pay extra for that bandwidth, but it's worth it and now is one of those times.

You'd be upset if Comcast looked over your usage and charged you $1 for streaming a movie from Netflix, wouldn't you? You're already paying them for bandwidth. And Comcast knows that.

So that's why they're charging the company that streams Netflix movies instead. Level 3, Inc., operates one of the internet backbones that Netflix uses to stream their content, and Comcast presented them with a "take it or leave it" offer on November 22. If they didn't pay up, Comcast subscribers wouldn't get Netflix, at least, not online.

"With this action, Comcast is preventing competing content from ever being delivered to Comcast’s subscribers at all, unless Comcast’s unilaterally determined toll is paid--even though Comcast’s subscribers requested the content," said Thomas Stortz, Level 3's Chief Legal Officer.

"Comcast, the largest U.S. cable TV company, has set up an Internet 'toll booth,' charging Level 3 whenever customers request content," sums Bloomberg. It may be a toll booth, but it's a phantom toll booth, at least to Comcast customers. If Level 3's costs go up and they charge Netflix more, and Netflix's costs go up, and they charge you more, that's...well, that's good for Comcast's On-Demand division, isn't it?...

This morning, the following roads are closed:

- 1700-2200 block of East Madison Street

- 19th Avenue Eeast and Boyer Avenue West

- Dravus Street from 20th Avenue West to 27th Avenue West

- 6th Avenue South from Yesler Way to South Main Street

- Northeast 51st Street and Latona Avenue

- Northeast Denny Way from Melrose to Stewart

- 23rd Avenue East at Alder Street

- Marion Street between 1st and 2nd Avenue

- Northeast 50th Street at University Way

- Northeast East Marginal Way South at South Michigan Street

- 6th Avenue at Madison Street

You may have heard that last month Seattle City Council voted to create an "opt-out" law for phone books. This is the first law of its type in the nation and if Yellow Page publishers Dex One Corp., SuperMedia, and the Yellow Pages Association get their way, it will be the last.

The trio has filed suit in U.S. District Court for the Western District of Washington on the grounds that the law violates the companies' Constitutional right to freedom of speech, as well as the interstate commerce clause. They also maintain that an opt-out registry will confuse Washington State consumers.

The City Council has estimated that the law will save the city $350,000 per year in recycling costs. [Ed.: Defending itself from inane lawsuits will of course cut into that.]

The Boeing Company has called a halt to test flights of its 787 Dreamliner, after an electrical fire "affected the cockpit controls and the jet lost its primary flight displays and its auto-throttle," reports the Seattle Times. The plane made an emergency landing in Laredo, Texas, with 42 people on board.

A lot depends on the cause of the fire, and whether it was a simple equipment malfunction or was the result of a more serious design flaw.

Either way, says the New York Times, "[s]everal analysts said they doubted that Boeing, which is counting on the jet to vault past in total sales, would meet its deadline to deliver the first 787 by next March."

Every story in the media takes the opportunity to mention that the Dreamliner is almost three years behind schedule at this point, thanks to Boeing management's attempt to outsource the company's supply line. Multiple issues with Italian manufacturers and even a problem with the work of the venerable Rolls Royce engine-makers have thrown the 787's ship date drastically off schedule....

Weyerhauser just reported net earnings of more than $1.1 billion in the third quarter, which works out to $3.50 per share. That's exciting news for shareholders, in that it demonstrates conclusively that Weyerhauser's ongoing conversion to a REIT is a canny move. County and state officials might have a different take; the Wall Street Journal says REIT-sizing "should slash Weyerhaeuser's tax rate to nil as it tries to improve results."

It's the single most profitable thing that Weyerhauser has done over Q3, in that if you exclude the $1 billion booked for tax adjustments, per-share profit falls to $0.25. In terms of actual business, Weyerhauser's Cellulose Fibers division led the way, up $15 million in year-over-year profits, to $181 million total for Q3.

Otherwise wood products sales were affected by the weak housing market, said Dan Fulton, president and chief executive officer, adding: "The housing market also affects our Timberlands business, where we continue to defer harvest due to lower log demand." Weyerhauser warned that fourth quarter operating earnings are expected to be lower than the third, due to soft markets in all areas.

Amazon has reported net sales were up 39 percent in the third quarter of 2010, and that Kindle sales were.... Well, there are no numbers attached, but the general impression is that they're selling Kindles at a fine rate, and proud we are of all of them. Interestingly, while media sales were up 14 percent, sales of electronics and other merchandise grew 68 percent.

Amazon has reported net sales were up 39 percent in the third quarter of 2010, and that Kindle sales were.... Well, there are no numbers attached, but the general impression is that they're selling Kindles at a fine rate, and proud we are of all of them. Interestingly, while media sales were up 14 percent, sales of electronics and other merchandise grew 68 percent.

Amazon may be the leader in online retail, but Forbes wonders how good the investment angle is, given Amazon's legendarily razor-thin margins. One impact on those margins, as TechFlash reports, is that Amazon has increased its employee headcount by 44 percent from last year. (An earlier story noted that "Fulfillment costs in Q3 were up nearly 46 percent from the year-ago quarter, to $680 million.")

Amazon moved into its South Lake Union offices earlier this year, and now the area is full of hustle and bustle--forget a quick bite to eat at Blue Moon Burgers if it's anywhere around noon. Back on Beacon Hill, the ex-Amazon Tower is forlornly waiting for its lease to expire next May; in three years, nobody the size of Amazon has come knocking to rent the 16 floors.

Delta has essentially told Boeing "No thanks," when it comes to the 787 Dreamliner. The airline has pushed its 787 order back a dozen years, at which time it could convert the order to other planes, as needed. The first thing that springs to mind is that Boeing really needs to double down if they're going to ship the 787 in just twelve years.

Delta has essentially told Boeing "No thanks," when it comes to the 787 Dreamliner. The airline has pushed its 787 order back a dozen years, at which time it could convert the order to other planes, as needed. The first thing that springs to mind is that Boeing really needs to double down if they're going to ship the 787 in just twelve years.

The Seattle Times also reports that Boeing is thinking about moving the tail construction of the second 787 model back in-house, the work of the Italian mechanics of Alenia not measuring up. Previously wing stress near the fuselage (wings by Mitsubishi, fuselage by Fuji) created delays, and Boeing management, perhaps smarting at not having a union to blame their failures on, seems to have taken the lesson on outsourcing.

That said, there's much more to Boeing than long-delayed commercial aircraft; the company is proudly displaying photos of its first production unmanned rotorcraft, the "Hummingbird," and the Army is going Apache III. Meanwhile Boeing reported profits of $837 million in the third quarter of 2010, and is issuing a dividend of $0.42 per share.

This scarecrow and its crop of pumpkins illustrates the prevailing mood of cautious optimism. Photo: Flickr's Great_Beyond.

This scarecrow and its crop of pumpkins illustrates the prevailing mood of cautious optimism. Photo: Flickr's Great_Beyond.

Umpqua Bank and the Puget Sound Business Journal welcomed area businesses to a crowded Four Seasons ballroom this morning, as Washington's chief economist Arun Raha, Michael Parks (editor emeritus of Marple's Letter), and Umpqua CEO Ray Davis held forth on the economics of the year ahead.

This morning's key pronouncement from Raha--"What we need now is just a few months of nothing going wrong," a big laugh line as it turns out--contrasted strongly with the suppressed panic of the last big economic forecast I attended in December of 2008. The mood now is one of growing impatience, having seen the worst, with the progress of recovery--though all the panelists were careful to emphasize that patience will be exactly what's required.

Raha led off with a short summary of where Washington state stands. We've seen a 6.1 percent overall decline in employment since the recession began (though, he noted, it technically ended a year ago), the result of a "castle of derivatives built on a foundation of sand." Community banks are still under stress (an assessment Davis backed up, saying he expected a number of bank closures still to come), and interest rates are likely to remain low, with "quantitative easing" being considered.

Currently we're somewhere at the bottom-right curve of a U-shaped recovery, which is why state unemployment has been more or less frozen at nine percent since March of 2009. (The recession, you remember, ended in June of '09.) If nothing upsets the recovery apple cart, we'll have "lost" five years to the downturn, which is not so bad as the 16 lean years following the Great Depression. Still, Raha doesn't expect to see much bounce-back in real estate until mid-2011.

Other areas (Boeing, Microsoft, exports) are showing definite signs of life: Boeing has six years of back orders to fill, and while the state lost 2,400 jobs in the software sector, we've gained back almost half that. Meanwhile, the export engine is only fueled by a weak dollar....

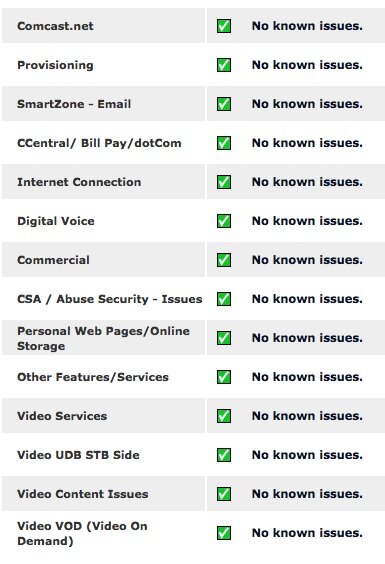

When internet service goes down, who should know about it first? In Seattle, it's not internet provider Comcast. Their customers announce the outages.

When internet service goes down, who should know about it first? In Seattle, it's not internet provider Comcast. Their customers announce the outages.

This morning, The SunBreak HQ, like many offices around Seattle, was abuzz with complaints about our Business-Class High-Speed Internet from Comcast. Pages were stalling, IM clients weren't loading, everything was slowed down to molasses speed. After performing the usual rites and incantations (unplugging the modem and router, restarting the laptops), nothing had improved.

I had limited connectivity, so I checked on Comcast's status: all green! But it did say, "Please sign in to see local Network Health messages," so I tried that. Still all green. It was time to try online support. 15 people were in the queue ahead of me, so it took 5-10 minutes for my customer service bot to ask me how my day was. Slow internet service? Had I tried unplugging everything? Oh. I had, eh? Well, perhaps I could provide my name and account number. Now if I would just wait a few minutes while they pulled up my account...

While this was happening, I was watching my Twitter stream to see if anyone else was having issues, and TechFlash tweeted "Comcast outage in parts of Seattle." Never mind, I told the bot, the outage is on your end, and signed out. Meanwhile, ComcastWA was tweeting to TechFlash's John Cook that they were "checking to see what's going on." This was about an hour into my experience, and it was the first tweet from ComcastWA on the subject.

By 10:30 a.m. the snafu was resolved, and someone from @comcastcares sent me a tweet to let me know. (Which, you know, thanks, but I can tell when the internet is working.) What's not explained is why Comcast's status maps were all green throughout the outage, or why support staff were telling people to try unplugging their modems and routers first....

Yesterday I took a two-hour of the Duwamish waterway, courtesy of the Port of Seattle, who each year offer a "Port 101" series to keep Seattleites informed on what being a port city means in the 21st century. (I can also recommend the Ship Canal tour.) We embarked from the Bell Harbor Marina, at Pier 66.

Argosy Cruises provided the boat. Joining us were representatives of the Environmental Protection Agency, Duwamish River Cleanup Coalition, Environmental Coalition of South Seattle, and Muckleshoot Tribe. Sitting next to me was a woman working in one of Boeing's environmental departments. Why all the enviro-brass? Because besides being scenic, the Lower Duwamish Waterway is a Superfund site....

"In its first quarter in the market, Apple's iPad shipments exceeded the combined volume of nearly 40 eBook reader suppliers with a 3.3 to 2.4M unit advantage," says IMS Research's Quarterly eBook and iPad Shipment and Forecast Service.

"In its first quarter in the market, Apple's iPad shipments exceeded the combined volume of nearly 40 eBook reader suppliers with a 3.3 to 2.4M unit advantage," says IMS Research's Quarterly eBook and iPad Shipment and Forecast Service.

Their press release goes on to mention that eBook readers still made a good showing, with volume up 28 percent quarter over quarter; Amazon gained share in the market, along with Barnes & Noble, but still refuses to release sales figures on its Kindle.

You get a sense of the market differential, though, when IMS Research mentions they expect Apple to ship over 15 million iPads in 2010, and all eBook readers to total 13 million. Next year they predict greater separation, with over twice the iPads sold as eBook readers.

Expect to see touchscreens and color in eBooks sometime in 2011, as manufacturers try to counter iPad popularity.

Hello!

Twitter: @thesunbreak | Facebook

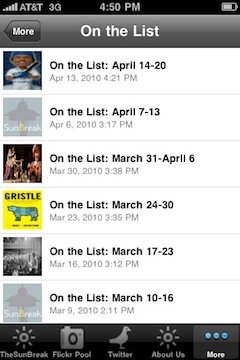

iPhone app download (Free!)

Subscribe to The SunBreak

Delivery Options

![]() Subscribe to all SunBreak Stories

Subscribe to all SunBreak Stories

Daily Email Digest of The SunBreak

Most Viewed Stories

Recently in Our Flickr Photo Pool

www.flickr.com

|

Our Facebook Fan Page

Neighborhood Blog News

Niche Blog News

Seattle Weather

Get the SunBreak iPhone App

Download the SunBreak iPhone app for free.

Most Recent Comments