So I'm sitting in the Elliott Bay Café in Pioneer Square, interviewing Vittana co-founder Brett Witt (hobbies: iPhone hacks, djing) and their international partnerships guy Nick Cain (skateboarding, water polo).

In quick succession we hit on Amazon's personalization (though Witt and CEO Kushal Chakrabarti don't work on Bezos' farm no more), Seattle's microfinance start-up scene (not to mention heavy hitters like Grameen, Unitus, Global Partnerships, too), and social media--and I realize I am scribbling this all down in a $1.29 notebook I got from Walgreen's.

Bloggers invented microfinance!

Actually, no, we did not. Neither did Muhammad Yunus, but the founder of Grameen Bank did a lot to prove that microcredit works--that right-sized lending creates a huge pool of potential investors and gives micro-entrepreneurs a chance to take financial risks that won't crush them.

With the nonprofit Vittana (they're also on Facebook), Kushal and Brett are taking microfinance in a new direction: college loans. Up to now, microlending has focused on the benefits of lending small amounts over short time frames. College loans are (someone has to say it) microfinance 2.0. That's why, I imagine, Huffington Post readers picked Vittana as the " Ultimate Game Changer in Philanthropy." (1.7 million votes were cast in ten "Game Changer" categories.)

A recent New York Times profile of Vittana summarizes the stumbling block: "Mainstream banks and others lend to microfinance institutions who in turn lend to small entrepreneurs because those loans support an activity that generates income. But a loan to a college student bears no immediate promise of repayment."

Especially in developing countries, the concept of government-funded student loans has yet to take hold, and prospective students are faced with the familiar Catch-22 of borrowers the world over: You have to be well-off to qualify for a loan.

The Times quotes Timothy Ogden, publisher of Philanthropy Action, to get to the real game-changing part: "If you’re trying to raise standards of living, making an education loan is probably a better way of doing that than lending another $100 to an illiterate and unskilled woman to open another roadside stand."

Brett Witt

"We just want to show that this is a feasible idea--a probable idea," says Brett, who's from Chicago's West Side, dredded, and brought you your Amazon Watch List. "One of our biggest 'products' or contributions to the field is just figuring out how student loans work [with a microfinance model]."

So far, Vittana has provided students with 33 loans worth $37,000 altogether, to students in urban areas of Paraguay, Nicaragua, Peru, and Mongolia. Vietnam and Cambodia are just coming online.

Right now, the average loan amount is just over $1,000, but "historically" (the site launched in May 2009), loans have ranged from $500 to $800. After their HuffPo fame broke, the number of lenders has doubled, which is good news because the number of students they put up on the site is tied to the lending resources available. Vittana lenders get their money back (in fact, there have been no defaults at all so far), but the loan is provided on an interest-free basis. All the cash transfers happen via PayPal.

The loans have a maximum term of three years: The student has up to twelve months of grace period, while they're in school, and then they have a maximum of two years (24 payments) to pay back the loan. "We have found that many students choose to forego the grace period," adds Nick, "so right now most of the repayment periods are twelve to eighteen months."

Nick Cain

Cain was formerly a Kiva Fellow, and brought to Vittana his relationships with microfinance institutions across Paraguay and Bolivia. The MFIs, as they're called, "administer the loan, meet the student, underwrite them, evaluate them, collect payments, and do all the work on that end," he explains. For that, the MFI will charge interest, an average of ten percent. Vittana does not (100 percent of the loan funds go to the MFIs for disbursement).

It's not some king of black magic--Vittana doesn't solve a student's poverty as such, though its founders believe that education certainly helps. "What a loan does is smooth out the process," he says. Having access to the lump sum needed for education eliminates educational stops-and-starts that keep students from finishing degrees.

Nick tells me a story as an example, of a young Managuan man whose parents had been saving for his college education, but then his father lost his job. He got a one-year scholarship, but then that ran out, leaving him very close to graduation, but facing a large fee to defend his thesis. He worked as a legal assistant as a law firm, and with the degree, would be paid more. He was a great loan candidate.

Before Vittana, Witt and Chakrabarti were working on Amazon's recommendation engine, trying to improve its results. Ultimately, they decided they were not booksellers for life. Working on Vittana's site "has its own rewards that aren't so much in the tech space," admits Brett. "I look forward to doing a lot of small little things with profiles that might have a huge effect on transparency and allowing people to have a one-on-one connection with the students on the site."

It's a different kind of personalization than surfacing shopping recommendations. At the moment, Vittana shows you the profiles for a 23-year-old Nicaraguan law student, a 48-year-old Nicaraguan education student, and a 21-year-old Vietnamese woman studying information management. You can see how close they are to getting their full loan amounts (the default contribution is $25). When you click through to someone's profile, you see their personal statement, their education history, and the city they live in.

When he heads back to the office, Witt says, he'll be working on community features, including commenting on student pages, a before-and-after income portrait, and a few other ways to help potential lenders get to know the students.

"One of the things that gets me most excited to see on the site is education," he says. "We're funding teachers who will go on to teach classes of 50 kids a year--the multiplying effect of that blows my mind. That's one of my favorite things to see someone doing."

As it's the holidays and the season of giving, Vittana has come up with a gift certificate that spreads the fun of gifting around: You buy it for someone, send it to them, and then they get to redeem the certificate for a student's benefit.

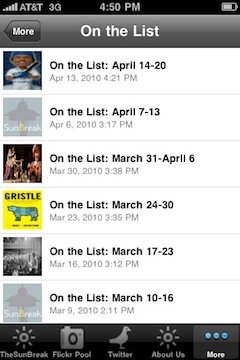

Subscribe to our Front Page Stories

Subscribe to our Front Page Stories

![]() Subscribe to all SunBreak Stories

Subscribe to all SunBreak Stories

Most Recent Comments