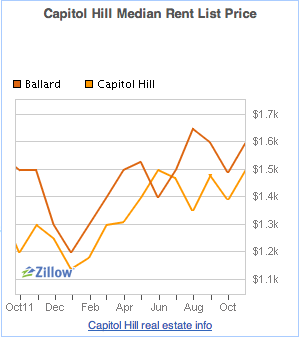

Capitol Hill Seattle notes that, in Seattle’s most happening neighborhood, rent prices are up 15 percent from this time last year, at least according to Zillow’s Rent Zestimate. In Seattle, there’s nothing to stop landlords from increasing the cost of month-to-month rentals at their whim, except that they must give 60 days notice if the increase is more than ten percent.

Even with thousands of new apartments on the way, concludes Everett Rummage, “with the city’s economy recovering, and unemployment continuing to fall, there’s no reason to expect the rent to remain anything but Too Damn High.”

That’s the opposite sloganeering spin of Seattle Bubble, where the headline is “The Rent Won’t Be Too Damn High For Long.”

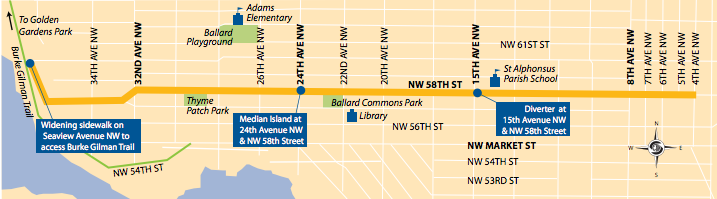

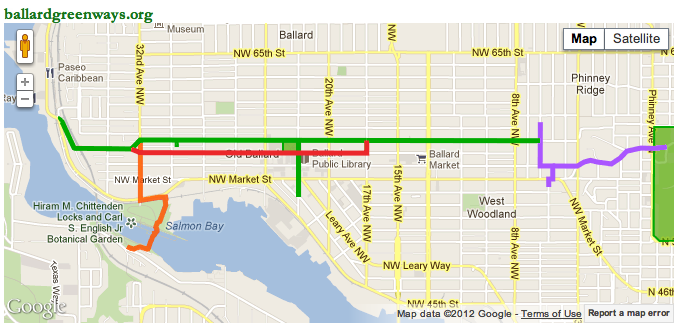

Tim Ellis is referring to Eric Pryne’s rental market story in the Seattle Times, which states that almost 8,400 apartment units are under construction in Seattle–the most in two decades. By summer of 2014, Ballard will have 70 percent more apartments to rent than it does now–not quite doubling in size. That will come by 2015.

Zillow pegged the median rent on Capitol Hill at $1,500 per month; supporting that price point, Pryne’s story mentions that a new apartment complex, The Lyric, is raking in about $2,000-per-month average. But Billy Pettit, vice president of investments for Pillar Properties, which owns The Lyric, told Pryne: “The data just don’t lie. Eventually, we’re going to see increasing vacancies, increasing concessions, decreasing rents.”

Yes, but for whom?

A median rental price of $1,500 per month, in a city with median annual income of $60,000, puts rent at a reasonable 30 percent of income. But if you assume that renters are, in the majority, people who can’t afford to buy, then it helps to break out the income distribution a bit more. In Seattle as a whole, 28 percent of households made $75,000 or less in 2010. 43 percent of that group made $45,000 or less, which means that paying the median rent represents 40 percent or more of their annual income.

In contrast, 47 percent (there’s that number again!) of Seattle households made $125,000 or more in 2010–which sounds like fabulous civic wealth, but it’s down from 54 percent in 2008.

What this means is that Rummage, Ellis & Pryne can all be right. Rent will decrease, first in overbuilt submarkets (and more slowly elsewhere as relocation shifts demand), and it still will remain “too high” for people on the lower end of the income distribution, since the new units are being built to house people in that $45,000 to $75,000 range. We have not, in other words, seen the last of aPodments.