![]() Not enough people are signing up and sticking with Amazon Prime, Bloombergian sources whisper, perhaps less than half of current analyst estimates of 10 million.

Not enough people are signing up and sticking with Amazon Prime, Bloombergian sources whisper, perhaps less than half of current analyst estimates of 10 million.

At $79 per year, joining Amazon Prime used to mean free two-day shipping, as a reward to the Amazonian power shoppers out there. It was pure, distilled Amazon thinking, creating feedback to drive the so-called 80/20 rule. Amazon would put its 20 percent on Prime steroids–they didn’t even have to know who those people were, because the Prime incentive would let their customers self-select.

But Amazon Prime has since become a sort of grab-bag, indicating a loss of focus in favor of a shotgun approach to generating sign-ups: How about “Unlimited instant streaming of thousands of movies and TV shows”? What would you say to: “A Kindle book to borrow for free each month”?

Geekwire points out that Amazon has been doubling down on Prime: “A 30-day Amazon Prime trial is included with the company’s Kindle Fire tablet, and Amazon is counting in part on subscription revenue to make up for the low $199 price of the device.” Shares fell on the news, which, unusually for Amazon, was about actual numbers. Previously, mentions the Seattle Times, Amazon Chief Financial Officer Thomas Szkutak had offered this conference-call guidance: “[E]arly stats that we’re seeing we like a lot.”

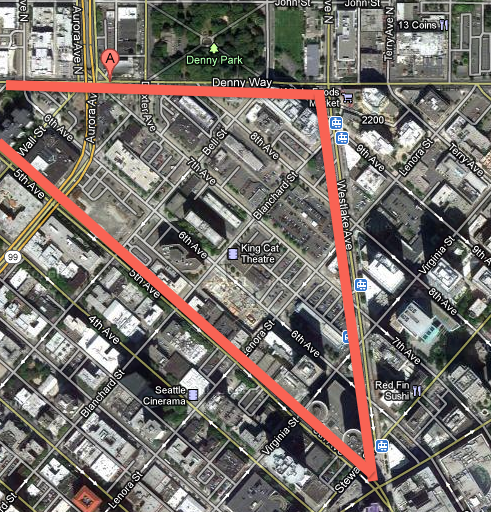

But Bloomberg also reports on Amazon’s “private” negotiations with Clise Properties, Inc., who have been trying to sell a 12-acre, triangular parcel of land (near Whole Foods) on Denny Way since 2007. Amazon has almost tripled in staff size since 2008, and they are hungry for more office space. (I’ve always assumed that, for the purposes of irony, Amazon would take over the old Seattle Times offices as well.)

This also is pure Amazon, which throughout its history has been second-guessed by a string of analysts, while the Bezos-led company has steadily forged its way toward greater growth. It’s fine, as a shareholder or prospective shareholder, to look askance at Amazon’s squishy guidance, but it’s worth noting that Amazon is, in fact, Amazon. It’s not that they don’t make mistakes, but they continually course-correct in favor of company growth, while refusing to apologize if that eats into short-term earnings reports. It is a story as old as Amazon itself, along with people buying on the dips.