Since the beginning of privatized liquor sales in Washington last June—for the first time since Prohibition—the question on everyone’s lips has been: Where are the cheaper prices we were promised?

Remember stories like this? “The owners of Shanahan’s Pub in Vancouver say they fully support 1183, because it will mean they can buy liquor at cheaper prices, and pass those savings on to their customers,” reported KOIN TV in 2011.

Despite public approval for Initiative 1183 in the early days, there were those who disliked it from the beginning. “Like a lot of craft distillers, Kent Fleischmann, co-owner of Dry Fly Distilling in Spokane, will vote against I-1183. He worries that prices for Dry Fly’s vodka and gin could be driven much higher by retailer and distributor markups, plus new fees imposed by the initiative. He figures a 750-milliliter bottle of gin and vodka could rise from $29.95 to $40, a daunting prospect,” reported the Seattle Times.

Unfortunately for Fleischmann (and the liquor buyers of Washington) his prediction turned out to be correct. A 750-milliliter bottle of Dry Fly gin is now regularly priced $34.99 at the Metropolitan Market, or $44.99 with tax. In fairness, as Metropolitan shoppers know, the prices there tend to be a few dollars more than most places, but it’s clear that we have not entered the free-market promised land.

Still, another question remains: Do certain stores, large or small, chain or independent, sell liquor at better prices than others?

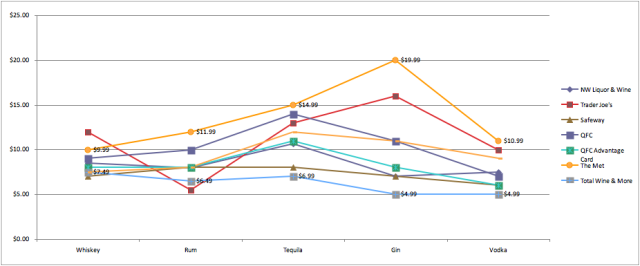

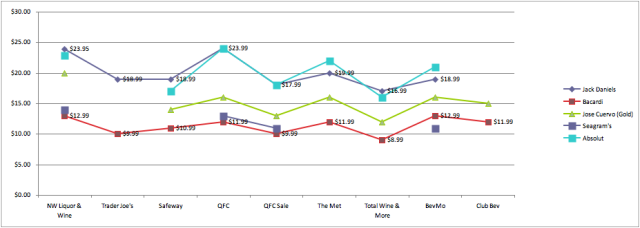

To find out, we compared the cheapest fifth of vodka, rum, tequila, gin, and whiskey at grocery and big box stores (for simplicity’s sake, we did not distinguish between Scotch, bourbon, etc., and instead just included the cheapest whiskey we could find—usually Canadian) at various outlets. Secondly, we conducted a price comparison of a fifth of Absolut, Bacardi, Jose Cuervo, Seagram’s, and Jack Daniel’s.

For the lowest liquor prices, the brands range from well-known, bargain-basement vodkas such as Platinum ($10.99 at Metropolitan Market) and Burnett’s ($9.99 at Trader Joe’s and 8.99 at BevMo), to Trader Joe’s brands that we had never heard of before, such as Rebel Yell Whiskey ($11.99).

Total Wine & More boasts a brand called American Pride that beats the prices everywhere else in tequila ($6.99), gin ($4.99), and vodka ($4.99). The cheapest whiskey we found was Monarch Canadian ($7.49) at BevMo; the cheapest rum, Montego Bay ($5.49) at Trader Joe’s.

At Metropolitan Market, as savvy shoppers might expect, prices don’t go very low at all. The cheapest rum brand was Bacardi ($11.99) and the cheapest gin, Beefeater ($19.99).

The reason we include the lowest price for every variety of liquor is to help readers gauge which stores have, overall, the least expensive brands. We are absolutely not recommending these as quality liquors. While the brand name American Pride might suggest a certain downhome dignity, its price of $4.99 for a fifth of vodka does not instill great confidence in brand quality.

We selected a hard-drinking neighborhood, collecting prices from several Capitol Hill grocery stores as well as one independent Capitol Hill liquor store and two of the new superstores. So far as the grocery stores go, the prices only differ by a few dollars. The QFC “regular” prices would make this store one of the more expensive places, but with a QFC Advantage card their prices closely match the other grocery stores. The prices listed in the chart for Safeway are those available with a Safeway Club Card.

The one independent liquor store we checked out, Northwest Liquor & Wine on 12th Avenue, did have slightly more expensive prices than the grocery stores for the brand name liquors we compared. However, their cheapest liquors were quite competitive with the other stores, and they even had the cheapest gin (McCormick’s $6.99) out of all the Capitol Hill stores, tying with Safeway (Essex $6.99), and beaten only by rock-bottom American Pride.