posted 04/21/10 10:34 AM | updated 04/21/10 10:34 AM

Featured Post! | Views: 0 | Comments : 1 | Politics

Washington, the Income-Tax-Paying, Pot-Smoking State?

Save and Share this article

Tags: income tax, bill gates sr., lisa brown, high-earner, dan evans, I-1077, initiative, B&O, property, tax

Hello!

The SunBreak is an online magazine of news & culture. It's a conversation about all the things on Seattle's mind (more about us). Got a post for us? We'd like to see it. Or just send us . If you'd like to contribute regularly, .

Twitter: @thesunbreak | Facebook

iPhone app download (Free!)

Twitter: @thesunbreak | Facebook

iPhone app download (Free!)

advertisement

Subscribe to The SunBreak

Regular reader? Subscribe to The SunBreak for just $1 per month, and help keep the news & culture coming. The subscription lasts for 1 year. Cancel at any time.

Delivery Options

Subscribe to our Front Page Stories

Subscribe to our Front Page Stories

Delivery Options

![]() Subscribe to all SunBreak Stories

Subscribe to all SunBreak Stories

Daily Email Digest of The SunBreak

Most Viewed Stories

Recently in Our Flickr Photo Pool

www.flickr.com

|

advertisement

Seattle Weather

Latest Headlines

advertisement

Neighborhood Blog News

Niche Blog News

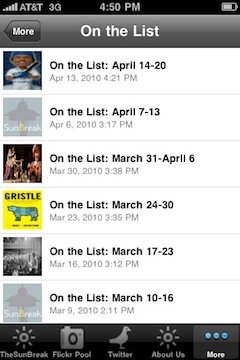

Get the SunBreak iPhone App

Take "On the List," our weekly picks of Seattle events & shows, with you wherever you go--along with all our SunBreak stories, always-on Twitter feed, and visually appealing Flickr photo pool.

Download the SunBreak iPhone app for free. You're gonna like the way you look.

Not a Member?

Sign Up

Most Recent Comments