Today the World Trade Organization released a confidential interim report on Boeing subsidies that the Wall Street Journal is already reporting criticizes payments to Boeing from the Department of Defense and NASA. And "without going into details," Ecology and Transport Minister Jean-Louis Borloo said, the report "finds in favour of the essence of the European Union's complaint."

UPDATE: Senator Maria Cantwell has issued a statement as well:

While I can’t discuss the details of the WTO’s preliminary ruling, I can say that the WTO panel rejected 75 to 80 percent of the European Union’s originally alleged subsidy claims. In dollar terms, the WTO found only a small fraction of the $20 billion in subsidies alleged by the EU. Most of those subsidies have long since been withdrawn. Importantly, the findings did not identify any existing prohibited subsidies, contrary to some media reports.

Allegedly unfair subsidies for Airbus and Boeing have been taking up a good deal of WTO staff time recently. France's stalwart defense of the WTO's ruling represents a marked shift since Airbus was found to have received some $20 billion in prohibited European subsidies in June. Then, the Wall Street Journal could find little WTO credibility on European shores:

Airbus officials said the EU would appeal the ruling. "There's not a single WTO case that hasn't been changed on appeal," an Airbus official said.

While on the one hand, the amount of aid appears roughly comparable in both instances (some $20 billion for Airbus and $24 billion for Boeing, which includes Washington state's tax breaks for the aircraft manufacturer), Boeing emphasized in a statement that there's subsidies and then there's subsidies....

The reception that Bombardier's fuel-saver C series is getting at the international air show, Farnborough, has Boeing and Airbus agreeing on one thing. Bombardier has got to go.

The Financial Times quotes John Leahy, chief of sales for Airbus, as saying:

If Airbus offers a new engine option and Boeing offers a new engine option on their 737, there is absolutely no business case for the CSeries at all. It ceases to exist at that point.

Both Airbus and Boeing are signaling--to potential buyers at Farnborough--that they are ready to move now on fuel efficiency if that's what customers need. Both the A320 and 737 models have been long-lived cash cows, and the airplane manufacturers have been waiting for a "Great Leap Forward" in engine design before committing to a major reworking. (Bombardier is predicting a 20 percent reduction in fuel use, and says its Pratt & Whitney engines will be four times quieter.)

Leahy mentioned September as a possible time for decision between "simply" adding new engines or redesigning the A320. According to the Boeing Twitter account, Commercial Airplanes CEO Jim Albaugh says, "our focus is extending 737, 777 and making them more efficient," and "decision on 737 most likely this Fall."...

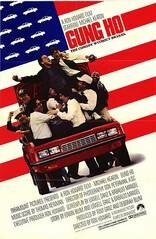

It's like a Bizarro-world "Gung Ho"!

It's like a Bizarro-world "Gung Ho"!

Over at the Harvard Business Review, blogger Dick Nolan (Boeing Philip M. Condit Professor of Business Administration at the UW's Foster School of Business) thinks Boeing's Trojan Horse moment was in outsourcing that famed Boeing know-how. Writes Nolan, "Before the 787, Boeing had retained almost total control of airplane design and provided suppliers precise engineering drawings for building parts (called 'build to print')."

Not that that has changed entirely--ironically enough, here's this recent headline from the Wall Street Journal: "Boeing takes control of plant." But that's a South Carolina plant. For the 787, Boeing has constructed 300-partner supply chain that spans the globe.

Continues Nolan:

Boeing effectively gave Tier 1 suppliers a large part of its proprietary manual, "How to Build a Commercial Airplane," a book that its aeronautical engineers have been writing over the last 50 years or so. Instead of "build to print," Boeing provided suppliers with performance specifications for parts and components and collaboratively worked with them in the design and manufacturing of major components such as the wing, fuselage section, and wing box.

The only problem is that once Boeing has trained and retooled its far-flung suppliers, it will have planted a worldwide crop of competitors. China, Nolan thinks, is the most likely to run with the commercial airplane ball. Airbus has already agreed to a Chinese final-assembly plant, work that it, like Boeing, has tried to keep "stateside."

So forget South Carolina: Asia's lower-paid workforce is learning from the best how to build a plane from nose to tail, and how to put it together and sell it for about fifteen percent less (per Nolan) than Airbus or Boeing. It's a fait accompli, a matter of when, not if.

Most Viewed Stories

- Flash! A Mob Takes Qwest Field at Half-Time

- Opinion: An Atheist's Defense of "Everybody Draw Mohammed Day"

- Why Will Smith, Joe Montana, and Wayne Gretzky Are All Coming to Issaquah Tonight

- Gather 'Round, Children, and Hear the Story of Courtney Love's Bumbershoot Secret Show

- Film Forum Spotlights Leonard Cohen, Small-Town Ohio

Top Rated Stories

- Stars, Ice, and Impossible Beauty: Backpacking in the North Cascades [Photo Gallery]

- PAX Prime 2010: Nerds In The Mist

- Allez au Cinema! Avec "The French Project"

- Wheedle's Groove's Soul Men, Interviewed at Bumbershoot 2010 [Photo Gallery]

- (Don't) Save it for Later: The English Beat's Dave Wakeling, Interviewed

Most Recent Comments