When I arrived this afternoon to interview Remy Trupin, executive director of the Washington State Budget & Policy Center, about the nuts-and-bolts of state budget allocation, he was still shellshocked from this morning's state revenue forecast.

The short story is that the projected deficit for the 2009-2011 and 2011-13 budget cycles has grown by $1.2 billion, to $5.7 billion, since September's forecast. The Hopper (the Senate Democrats blog) live-blogged the announcement, and that's where the following quotes come from:

Revenue for the remainder of the current budget cycle is projected to fall by $385 million to $28 billion. Revenue for the next cycle is projected to fall by $809 million to $33 billion.

"I would conclude that our forecast in September was more optimistic than it needed to be," said state chief economist Arun Raha, a qualification that should be immediately registered in a collection of classic understatements. Almost $300 million of the shortfall comes from the passage of I-1107, which rolled back taxes on bottled water, soda, and candy.

To balance the budget for the current budget cycle with cuts, the budget would need to be reduced by almost eleven percent across the board. To meet this year's shortfall, said Marty Brown, director of the state's Office of Financial Management, "We're going to be talking about Basic Health soon, Disability Lifeline soon, levy equalization. School districts are going to get nailed." ...

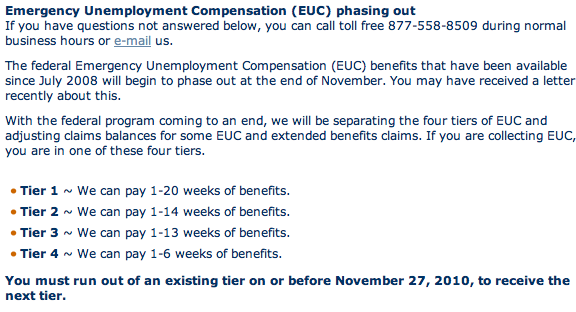

On November 30, two federal unemployment programs are set to expire: Emergency Unemployment Compensation and Extended Benefits. HuffPo notes that while the House has a vote coming up on an extension, the Senate has nothing on its schedule, so it is likely that--across the country--hundreds of thousands will no longer get unemployment checks.

Here in Washington State, the Employment Security Department's Jeff Robinson told me that the high-end estimate is that some 50,000 to 55,000 workers will have exhausted their emergency, longterm benefits by the end of the month. (That's a cumulative number, counting since Congress implemented Emergency Unemployment Compensation in July 2008. "More than 25,000 already had exhausted their benefits as of Oct. 31," the ESD told legislative committees yesterday.)

There are tiers to unemployment payments these days, after the unemployed worker has exhausted the state's typical 13 to 26 weeks of unemployment insurance. Federal emergency extensions have created four tiers totaling 53 additional weeks of benefits. ESD has created an "Impending Storm Workgroup," to help deal with the thousands of people losing a weekly income and to explain to people counting on those "extra" weeks that things have changed: Anyone who files a new claim after November 27 will be limited to 46 weeks of benefits.

What has not changed is Washington's unemployment rate, which refuses to budge from nine percent (9.1 percent if you want to enjoy an imaginary granularity; a year ago, the rate was 9.2 percent). Perhaps because this month is my birthday, the Seattle Times put Sanjay Bhatt to the task of surveying the state's unemployment situation, and the result is grim--18 percent of state residents are "underemployed"--but more inclusive in context, and accurate, than the Times has been inclined to dish up previously. ...

CNBC asked Governor Gregoire to respond to analyst Meredith Whitney's comparison of states to banks, pre-financial crisis. Here's what Whitney said in late September:

The similarities between the states and the banks are extreme to the extent that states have been spending dramatically and are leveraged dramatically. Municipal debt has doubled since 2000, spending has grown way faster than revenues.

Whitney said what reminded her most strongly of the banks' situation was the absence of "reliable data on state spending and debt."

Governor Gregoire chose to play off the phrasing, saying that, "We're in crisis mode. We the states are not in pre-crisis at all." That's no doubt true, but it evades Whitney's point that state spending and debt now represent a separate economic danger from the banks' credit meltdown, and that transparency is hard to come by. In fairness, Washington's credit rating is quite good, but with the caveats that a) if credit ratings were infallible, we wouldn't be in the crisis we're in, and b) things can change very quickly.

Gregoire noted that Washington has trade to rely on; unusually, we don't have a trade deficit with China. And state economists see mainly good news in that relationship for the future. Yet the state has to figure out how to avoid a $3 billion deficit over the next two years, and cuts have approached the bone. CNBC says:

In August, Gregoire announced plans for four- to- seven percent budget cuts across the board, as well as a phase-in of $51 million in cuts to state welfare aid. The cuts will disqualify nearly 2,500 families from child-care subsidies in October, and an additional 5,500 families from cash welfare benefits in February....

(more)

This scarecrow and its crop of pumpkins illustrates the prevailing mood of cautious optimism. Photo: Flickr's Great_Beyond.

This scarecrow and its crop of pumpkins illustrates the prevailing mood of cautious optimism. Photo: Flickr's Great_Beyond.

Umpqua Bank and the Puget Sound Business Journal welcomed area businesses to a crowded Four Seasons ballroom this morning, as Washington's chief economist Arun Raha, Michael Parks (editor emeritus of Marple's Letter), and Umpqua CEO Ray Davis held forth on the economics of the year ahead.

This morning's key pronouncement from Raha--"What we need now is just a few months of nothing going wrong," a big laugh line as it turns out--contrasted strongly with the suppressed panic of the last big economic forecast I attended in December of 2008. The mood now is one of growing impatience, having seen the worst, with the progress of recovery--though all the panelists were careful to emphasize that patience will be exactly what's required.

Raha led off with a short summary of where Washington state stands. We've seen a 6.1 percent overall decline in employment since the recession began (though, he noted, it technically ended a year ago), the result of a "castle of derivatives built on a foundation of sand." Community banks are still under stress (an assessment Davis backed up, saying he expected a number of bank closures still to come), and interest rates are likely to remain low, with "quantitative easing" being considered.

Currently we're somewhere at the bottom-right curve of a U-shaped recovery, which is why state unemployment has been more or less frozen at nine percent since March of 2009. (The recession, you remember, ended in June of '09.) If nothing upsets the recovery apple cart, we'll have "lost" five years to the downturn, which is not so bad as the 16 lean years following the Great Depression. Still, Raha doesn't expect to see much bounce-back in real estate until mid-2011.

Other areas (Boeing, Microsoft, exports) are showing definite signs of life: Boeing has six years of back orders to fill, and while the state lost 2,400 jobs in the software sector, we've gained back almost half that. Meanwhile, the export engine is only fueled by a weak dollar....

"FREE HOMES" courtesy of our Flickr pool's photocoyote

"FREE HOMES" courtesy of our Flickr pool's photocoyote

What's it all mean? The latest concern over messy mortgage paperwork injects more uncertainty into people's already uncertain lives. The Seattle Bubble reports "foreclosure notices are still rising rapidly year-over-year." FBR Capital Markets analyst Paul Miller says foreclosure delay losses could range from six to ten billion dollars. Any delay in processing will simply drag out the larger real estate market reset.

But the burning question once again--as with the subprime loan meltdown--is what the size of the problem is. Are these errors that can be corrected, or have lenders fast-tracked themselves into writing unsecured loans?

When I first heard that banks were halting foreclosures, I thought, naively, that they were attempting some kind of homeowner assistance program. But it turned out that banks have been illegally foreclosing on homeowners, through what's known as "robo-signing"or otherwise cutting corners.

In Washington state, Attorney General Rob McKenna says that investigators responding to complaints have found "inaccurate documents, conflicts-of-interest, faulty chains of title and failures to provide the disclosures and conduct mediations required by law." He's asked 52 Washington foreclosure trustees to suspend action on any "questionable" foreclosures....

Technically--technically--the news is that the Coalition of City Labor Unions have agreed to a new contract "in which thousands of city workers will accept lower cost-of-living increases for three years," says the City of Seattle. But given that the city is facing a $67 million deficit, and this move saves only $2.1 million, the upshot is that Mayor McGinn will be scrounging for every dollar from parking, permits, and licenses that he can find.

For the record, I am pro-union in general principle. Union jobs remain one of the few ways people can achieve a relatively secure middle-class lifestyle. Unions are a last bulwark against the corporate profit-taking that can decimate working communities.

But I choke a bit when, after what's clearly the mostly vicious economic downturn since the Great Depression, the Coalition of City Labor Unions "shares the pain" via a tiny raise, and (since they were promised a two-percent annual cost-of-living increase) it's characterized as accepting grim reality:

With today's announcement, 8,500 of the city's 10,600 employees, or about 80 percent, are taking some kind of reduction in pay....

(more)

Readers of The SunBreak will have noted we have been relatively quiet on the subject of Mayor McGinn's proposed budget for next year. (Vote for your cranky cost-saving measures here.) I simply have not been able to get my arms around the beast, outside of general outlines.

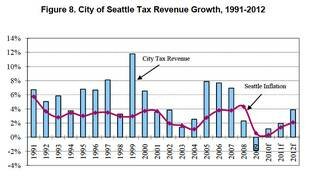

One delineation to make is that this budget crisis is a revenue problem, not a wasteful city spending problem. In 2008, the general fund budget was $925 million, last year it was $905 million, and this iteration is $888 million. Meanwhile, the city's four main revenue streams--taxes on utilities, sales, businesses, and property--growing at six to eight percent annually in the boom years, fell off a cliff in 2009, entering negative territory.

One delineation to make is that this budget crisis is a revenue problem, not a wasteful city spending problem. In 2008, the general fund budget was $925 million, last year it was $905 million, and this iteration is $888 million. Meanwhile, the city's four main revenue streams--taxes on utilities, sales, businesses, and property--growing at six to eight percent annually in the boom years, fell off a cliff in 2009, entering negative territory.

Another bright, shining line is the difference between the general fund and the total city budget, which last totals over $3.8 billion dollars. That is, almost 80 percent of what the city spends annually lies outside the general operating budget. Instead over 200 city staff are being fired. That's why Ken Schramm, no mayoral ally, says suck it up when it comes to parking rate increases. There ain't no easy way out.

Still, Mayor McGinn says he welcomes fierce argument over his budget choices, and Blogging Georgetown has responded with a critique of cutting library hours and services at a time when they are needed more than ever. "The old man" has graciously allowed us to republish his broadside:

The mayoral candidate that allegedly lavished such love on South Park during the election is proposing cutting librarians from the South Park branch of the Seattle Public libraries. According to the [Seattle] Times, the budget that he submitted to the city council included cuts from SPL, including "Delridge, Fremont, International District/Chinatown, Madrona-Sally Goldmark, Montlake, New Holly, South Park and Wallingford — [which would] would lose their librarians. The buildings would be open 35 hours a week for collections, computer access and holds-pickup."...

"Buyers know that now is the time to get the big home with a view at a price that is hundreds of thousands less than just a couple of years ago, and at an incredibly low interest rate," says West Seattle Redfin agent Dan Mullins. He wasn't talking about condo auctions specifically, but he captures the appeal succinctly.

For real estate market watchers, the auction is also a useful barometer. Over the weekend, 32 condos in the luxury condominium tower Olive 8 hit the auction block, and the results support those dismal few prognosticators who suspected, back in the boom days, that the market was overvalued by some 30 percent.

For real estate market watchers, the auction is also a useful barometer. Over the weekend, 32 condos in the luxury condominium tower Olive 8 hit the auction block, and the results support those dismal few prognosticators who suspected, back in the boom days, that the market was overvalued by some 30 percent.

Keep in mind, while perusing the Olive 8 sales, that this is what a luxury downtown condo goes for. Wendy Leung at Seattle Condo Review gives you a great by-the-numbers breakdown (with more granularity than you'll find in the Seattle Times Olive 8 auction story):

The homes were sold for an average of 66% of the previous listing price, which is very close to the average of the last few auctions (Queen Anne High School, Lumen, Brix, Gallery, and 5th and Madison) since 2009 at 67%.

Leung goes on to separate out high and low bids by condo size, and to work out their price per square foot. While the average discount from list price was 34 percent, a larger two-bedroom went for only 54 percent of list. The units being sold ranged between the 18th and 26th floors in the 39-story tower--the more expensive units above, over 100 unsold, have "price tags from $500,000 to $6.9 million," says the Seattle Times, who also make room for a cheery broker's quote:...

Several months ago, writes the Seattle Chamber's Christine Donegan, Seattle employers issued a joint appeal to Mayor McGinn and City Council to avoid raising taxes to balance the 2010 and 2011 budgets. As a follow up, twenty-two business organizations have issued a letter to the mayor and council with specific suggestions for balancing the budget without negatively impacting employers or essential city services.

Mayor Mike McGinn, introducing The Maldives at Bumbershoot

Mayor Mike McGinn, introducing The Maldives at Bumbershoot

Dear Mayor McGinn,

In April, over two dozen representatives of Seattle employers wrote to urge you to refrain from increasing existing taxes and proposing new taxes to balance the City’s 2010 and 2011 budgets. We believe that burdening employers with additional taxes will slow economic recovery in Seattle. As a follow up to that letter, we write to offer specific suggestions for balancing the City’s 2011 budget that will preserve jobs and critical City services.

As you are well aware, the City of Seattle faces a projected $67 million shortfall between planned expenditures and anticipated revenues in 2011, with $11 million less in revenues than previously predicted. However, the City is projected to collect more General Fund revenue in 2010 than was collected in 2009 and this trend is anticipated to continue through 2012.

Between the year 2001 and 2011, General Fund revenues will have grown by 45 percent, 18 percent when adjusting for inflation. The City’s budget shortfall is not driven by decreasing revenues, but rather as a result of expenses that are increasing at a rate greater than revenues and a rate greater than Seattle’s Consumer Price Index (CPI)....

Written from within the luxuriously appointed media room at Bumbershoot, stocked with both apple *and* orange juice!

"An agonizing crawl" is how the state's chief economist, Arun Raha, describes the economic recovery in Washington. "Anemic," "risk," "uncertainty," and "weaker" are also keywords. While corporate profits are now higher than pre-recession levels, Raha says:

We have cut our 2011 employment growth forecast roughly in half, from 2.7% to 1.3% (annual average basis). We do not expect to reach our prerecession peak in overall employment until the second quarter of 2013.

On the local front, both Costco and Nordstrom won praise from Barron's for their Q3 results. TechFlash reported on AT&T's boost to the signal at Qwest Field and Husky Stadium. The Storm continue to be awesome. Native Americans are understandably still outraged that a wood carver was shot to death by Seattle police. Keeping the unfortunate streak going, police shot an armed, reportedly suicidal man in West Seattle yesterday. Sound Transit will run one-car light rail during low-demand times to save money.

In Belltown, the Croc is "absorbing" the Via Tribunali space. The CD News had their own armed shooter to report on. Eastlake was plagued by a rash...of car prowls. A medieval country faire is holed up in Volunteer Park this weekend, battling the tide of modernity that is PAX. Blogging Georgetown envisioned Airport Way South on a diet. Watch out for angry Ents: 140 trees are being displaced for the Mercer Street Improvement Project. Yesler Terrace historic?...

"As of late last year, only 28 percent of small businesses were using bank loans, the lowest rate since 1993," notes the Seattle Jobs Plan, unveiled yesterday by Mayor McGinn.

A chunk of the $50 million in business financing that the city plans to distribute within an 18-month window will go to start-ups and small- and medium-sized businesses looking for loans to help them invest in operations or expand.

Millions more in tax exempt stimulus bonds and tax credits are targeted at large businesses, with a priority given for "projects that create or retain permanent jobs, increase the availability of goods, and serve as an anchor for future economic development in low-income communities."

It's a plan that seems to include the kitchen sink--job training and preparation for college is in there ($2 million), interim parking lots near light rail stations, street food vendors, a city-owned broadband network expanded to homes and businesses, urban farming, and energy-efficient retrofitting ($26 million).

Totaling it all up, the city expects to create around 10,000 jobs in the next few years, reports Seattlepi.com, while it's not really on the hook for much of the financing: "roughly $70 million for business loans and tax credits come from new federal funds and leveraged local dollars from partnerships."...

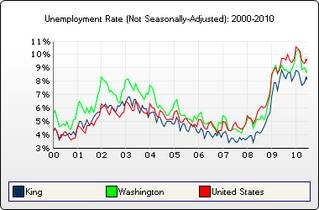

King County's unemployment rate (ESD)

King County's unemployment rate (ESD)

"State jobless rate drops to 8.9% in July" reads the Seattle Times headline. (Et tu, TechFlash?)

We're a metrics nation (even if that whole metric thing never took off), so it's understandable that people follow numbers closely to see what news they contain. But some people seem to want numbers to deliver action-verb news monthly, even when the economy is clearly stagnating.

When Washington's Employment Security Department announces that "Washington's seasonally adjusted unemployment rate fell to 8.9 percent from June’s upwardly revised level of 9.0 percent," it helps to remember that June's rate was originally 8.9 percent. Comparing unrevised numbers then--apples to apples--absolutely nothing happened.

But something did happen, of course. As ESD's July report states right at the outset, "Washington state, on a seasonally adjusted basis, shed 2,300 jobs between June and July 2010." The ESD news release on July's numbers focuses instead on our anemic but actual private-sector job growth.

The private sector added 3,100 jobs in July, led by 1,000 in transportation, warehousing, and utilities. Construction and education and health services grew by 900 jobs over the month.

Almost 240,000 people were anxiously awaiting their UI checks in July, but a growing number have simply reached the end of that rope. ESD's David Wallace tells me, "Since Congress implemented Emergency Unemployment Compensation in July 2008, the State of Washington has had a total of 15,848 claimants that have exhausted benefits."...

The Puget Sound Business Journal has a very good report on Washington state unemployment. As TSB readers know, I'm critical of unemployment "movements" on the order of a tenth of a decimal dutifully parroted as a "drop" or "spike." (Meanwhile, no headline screams "National payroll number for June revised, 221K jobs lost, not 125K.")

Not because of unemployment's valency in political horse-race season, but simply because real-world decisions on things like unemployment extensions hinge on whether politicians and their constituents believe things are getting better or worse.

For context, the last time Washington's well-massaged unemployment rate stood at 8.7 percent was 1992. The dot-com reset crested at 8.3 percent. So if things are any "better" right now, they're also the worst we've seen in eighteen years.

Greg Lamm's PSBJ post tackles another measurement, of overall "labor underutilization" (broken out in categories U-1 to U-6). Category U-6, for instance, includes people who have been out of work so long they have stopped looking or who have taken part-time work just to pay bills. "By that measure, Washington’s unemployment rate was 17.4 percent for a period that spans the third quarter of 2009 and the first two quarters of 2010," writes Lamm....

Escala's news release last Wednesday reported 65 new sales, with 38 closings, in the last three months. That's 38 of a total of 275 units, after the condo tower reopened with prices reduced 20 to 50 percent at the end of March. (Last February, the PSBJ was reporting that only six units had sold, and current King County tax records show just eleven units in private ownership.)

Designed by Thoryk Architecture (Mulvanney G2 were architects of record, and DiLeonardo International, Inc., did the interior design), the 30-floor, $370-million tower from developer Lexas Companies has come down in the world since 2006, when you could "reserve a home" with a $10,000 deposit. (Urbnlivn took the video above, and wrote a review, after touring an open house.)

The idea was to overwhelm Seattle's highest-living with luxury amenities, including a "spa, library, billiard room, theatre/screening room, fitness center with a lap pool, a catering kitchen, a formal dining room, and an events center." There was a marble staircase at the entrance, of course.

In 2007, as the Seattle Times reported, it was the "year of the condo" in Seattle: "Real-estate economist Matthew Gardner shared Thyer's optimism, telling an audience of about 700 that demand for new places to live downtown will remain 'very positive.'"...

Our analyst, keeping an eye on the market.

Redfin has their monthly state-of-the-market real estate report out, and the headline is "Prices Up, Fundamentals Down" (for June compared to May). By "up," they mean a 1.7 percent price increase, and by "down" they mean inventory grew five percent, in tandem with the number of houses sold dropping two percent.

While sellers weren't budging on price--last month--a Redfin agent says owners taking on thousands of dollars in post-inspection work is becoming more common.

In Seattle, inventory increased by double-digit percentages in Maple Leaf, Queen Anne, and Ravenna. Pickings are much slimmer in Capitol Hill, Magnolia, and Greenwood. Seattle's median home price ($450,000) was down negligibly from May, 1.4 percent, and showed no change from June 2009, at $334 per sq. ft. That varies appreciably in-city: Queen Anne is $445 per sq. ft. and Beacon Hill is $248 per sq. ft.

Perhaps not coincidentally, the slight drop in Seattle's median was the result of increased sales volume in areas like West Seattle, where the median dropped about eight percent.

If it's condos you're looking for, Redfin shows almost 3,000 units for sale in Seattle; the lowest median list price is in Rainier Valley, at $133,000. For contrast, the median around Pike Place is $650,000. The median list for Capitol Hill condos is down almost 15 percent from June 2009.

Graph: Washington State Employment Security Dept.

There are likely over 100 headlines about Washington's unemployment rate today that are using some variation of "drops" or "falls," and it's making my head hurt. That's not just because the gains are almost entirely due to temporary jobs added by the 2010 Census (all but 200 of the 8,600 jobs added were governmental).It's because it strains the meaning of the word "drop" to use it in describing a 0.2 percent difference, especially with a measure that wasn't designed to offer that kind of real-time accuracy (monthly results, so breathlessly reported initially, are often revised). It's like our headline writers are all devotees of The Secret.

What is true is that, apples to apples, we're measuring the same rate of unemployment as May 2009, says AP. You might think that a year has gone by with no appreciable improvement, but even that's not true: the state has 27,000 fewer jobs, year-over-year (30,000 less in the private sector). That's the difference between a rate and absolute numbers.

(More fun with numbers: the monthly unemployment rate is derived from a survey that counts people who are "actively seeking work." If you don't have a phone, have given up trying to find a job, were desperate enough to take a part-time or contract position, or have gone back to school to retrain, you're not unemployed.)

Signficantly, you don't find the word "falls" in that AP story's quote from Dave Wallace, chief economist at the Employment Security Department:

[Wallace] cautioned that because of the temporary nature of the Census jobs, "it's a mixed or neutral job picture."

He said in all, the private sector only saw a net gain of 200 jobs, which is "pretty much treading water."

Any bets on how many headlines include that phrase, "treading water"? Other than this post's, I mean? And while the unemployment rate can be said to be treading water, the unemployed cannot.

Seattle is "ready for take-off," ranking just behind Austin, TX, on Kiplinger's "Best Cities for the Next Decade" list, which gives points for innovative thinking. Topeka, KS, was tenth. Portland didn't make the list. Kiplinger's is a personal finance and business magazine that apparently needs the kind of publicity that running a Top 10 list will bring you. (Just like we're the kind of magazine that reports on Top 10 lists!)

Senior editor Robert Frick lays out the rationale: "It’s no coincidence that economic vitality and livability go hand in hand. Creativity in music, arts and culture, plus neighborhoods and recreational facilities that rank high for 'coolness,' attract like-minded professionals who go on to cultivate a region’s business scene."

Ironically, the lede's money quote is from Mark Emmert, our skipping-town president of the University of Washington: "We only have two products here: smart people and great ideas." Kiplinger's is bullish on Boeing and the 787, the University of Washington's research-dollar magnetism, our global health scene (Gates Foundation, Washington Global Health Alliance), and clean tech (McKinstry).

They also noted we have tons of office space, and close with a quote from the OECD's Stephen Johnson: "We realized with this recession that our city and region need to be much more aggressive in business development."...

"VERY URBAN" is the title of this shot of the formerly-known-as-WaMu tower by photocoyote.

Colliers International has released its spring "knowledge report," looking back on Q1 and forecasting for the year ahead. The good news for Seattle is simply that no new commercial real estate came on the market in the first quarter, so the vacancy rate for the year-to-date, about 17.7 percent, remained the same as 2009. (Next quarter brings the opening of 505 First Avenue, with almost 290,000 sq. ft. added to the 1 to 1.5 million sq. ft. available.)

For now, landlords are holding the line on their offers and concessions to new tenants. But every month that goes by with an almost-20-percent vacancy rate represents a drag on the economy. A lot of mortgages out there were written dependent on rental income that's dropped precipitously. (See Beacon Capital Partner's claim that its rents now cover just 20 percent of its debt obligations.)

So Colliers' optimism about the housing and stock markets looks a little less persuasive at this precise moment. Here's their take:

With the residential housing market continuing to gain strength and the Dow Jones Industrial Average up nearly 4,500 points to its 19 month high (currently above 11,000), all signs point to positive economic growth.

Yet the Wall Street Journal reports that Chicago's unofficial "fear index" has jumped 18 percent following this week's market dive. Jon Talton at the Seattle Times notes that while the proximate cause may be concerns about Greece's sovereign debt, the market run-up has been driven by bail-outs (literally, and indirectly, in the form of low, low interest rates).

Seattle Bubble has been keeping tabs on the residential housing market, and while there's been the usual spring flurry of sales, take a look at the second graph here, the next time someone mentions a "strong recovery."

The Puget Sound Business Journal dug into King County foreclosures, and found that Seattle is, anomalously, still reporting increases in foreclosure-related "distressed sales: "By June, it’s estimated that more than 800 homes will be scheduled for auction in any given week. That’s up from an average of about 40 auctions a week in 2006 and 2007. Many of the homes don’t sell at auction." (About two-thirds of the foreclosures they tracked last year didn't sell.)

As much as I like to rail about government bureaucracy--come on, who doesn't?--I often see signs that our government is populated by hard-working, competent people. (Whoops, there go our eastern Washington readers.)

As much as I like to rail about government bureaucracy--come on, who doesn't?--I often see signs that our government is populated by hard-working, competent people. (Whoops, there go our eastern Washington readers.)

Yesterday I wondered aloud at the seeming discrepancy between a report that the state added 12,000 jobs in January, and another report that indicated our unemployment rate had either stayed the same or edged up imperceptibly.

Sheryl Hutchison, the state's Employment Security Department communications director, wrote in to explain, in refreshingly clear terms:

On the surface, it seems illogical that the unemployment rate could increase at the same time jobs are increasing. The answer lies in the definition of "labor force."

As the economy starts to improve and more jobs become available, discouraged workers will start looking for work again--thus increasing the total size of the work force. Since these individuals haven't found a job yet, it causes the unemployment rate to increase.

For several months now, our economists have been predicting this phenomenon would occur as the economy starts to pick up--and it appears that it's starting to happen. As illogical as it seems, it's actually a positive sign that the economy is starting to move again.

The question of whether an unemployment rate is what it says it is, if it doesn't count all the ready-to-work unemployed, aside, at least it makes sense. If and when the job market starts to get back to its feet, the news that people are hiring will draw thousands back to the labor force. The Seattle Times economy reporter Jon Talton vouches for this reading in his post today:...

Despite the PSBJ headline, "Washington unemployment rate rises to 9.3 percent," there's been no substantial change in unemployment. January's unemployment splits the difference between December's estimated percentage (9.5) and revised downward final (9.2).

What's slightly confusing is that the state claims to have added over 12,000 jobs in January. The Tacoma News Tribune says "job gains occurred in retail trade, educational and health services, leisure and hospitality, professional and business services, manufacturing and aerospace and parts manufacturing."

That would be three percent of the approximately 395,000 Washingtonians who are unemployed.

Statements were issued: "This is a positive sign for Washington state," said Gov. Chris Gregoire. "It’s encouraging to see jobs finally coming back," said ESD Commissioner Karen Lee. No one addressed the question of how 12,000 new hires would completely fail to impact unemployment. It's as if the two measurements had been somehow decoupled for the benefit of political press releases.

"Swan on Lake Washington 1987" comes with a story from shawnmebo: "This swan was mean as hell. He had a bad habit of attacking people. People with dogs. Let's just say it didn't end well for him."

"Swan on Lake Washington 1987" comes with a story from shawnmebo: "This swan was mean as hell. He had a bad habit of attacking people. People with dogs. Let's just say it didn't end well for him."

After a week of icy temperatures and steam fog, things meteorological are finally warming up...to snow. Cliff Mass says "not a lot" of snow is expected Sunday, but "enough to whiten the place." No matter how much we get, it should melt off when temperatures rise to the 40s next week. Still, to be on the safe side, now is a good time to start following Metro's crowd-sourced snow reports on Twitter.

You may not believe this--that's where FlightBlogger's video will come in handy--but Boeing has been taxi testing its 787 Dreamliner this morning. Here's a picture of the 787 moving under its own steam. Brakes look good.

Earlier in the week, Elliott Bay Book Company officially announced its move to Capitol Hill, with a spring opening planned. The Seattle Times took a sneak peek at the new digs. What'll be new: 85 parking spaces associated with the building, central heating, and--if they turn a profit--streaming videos of their author readings. There's also talk of a café "likely" run by Brasa's Tamara Murphy, which may create an indie café singularity in the Pike-Pine neighborhood.

In other local bidness news, Birgitta is having a going-outta-business sale this weekend, and Google informed us that our sponsor Central Cinema is one of Seattle's favorite places.

In the ghost-of-local-news-past category, there are questions about WaMu's seizure that just won't go away. The FDIC says Horizon Bank, Evergreen, and Rainier Pacific are all under-capitalized. Seattle Bubble also noted that Seattle's November foreclosures were up 45 percent from last year....

Wind storms mostly missed Seattle, but were still felt.

It's almost Thanksgiving, and there's a heartening amount of goodwill out there. After thieves stole about $2,000 worth of food from the Rainier Valley food bank, the food bank has almost disappeared under a flood of food and cash donations. The Seattle Times reports about $100,000 in donations have arrived so far.

If you're planning on traveling for the holidays, you'd better have booked your seats already. Seattle Transit Blog has the Amtrak update: even with extra service, Seattle-to-PDX trains are almost sold out. If you're flying, you might notice a new "holiday surcharge" on your fare. Here's a holiday travel checklist, courtesy of the Times.

A coyote has been wandering around Terminal 91, possibly hoping to take in the sights on an Alaskan cruise. (Holland America doesn't advertise with us--...yet--but who doesn't want to win a cruise?) Magnolia gets all the cool sightings. Cougars, coyotes, now orcas. West Seattle is still thrilled with the seasonal return of their brant geese.

Local homebuilder Quadrant Homes is being sued for "widespread, shoddy construction," reports Seattlepi.com. On the other hand, winemaker Columbia Crest's 2005 Reserve Cabernet Sauvignon was voted the best wine in the world by Wine Spectator magazine. That's all well and good, but for everyday drinking (not that you should drink every day), cognoscenti have been crowing about Columbia Crest's Two Vines label. I have been trying this out, and am on board.

On The SunBreak, I dug into the city council's proposed budget (after I started wondering how they were paying for those restored library hours) and state's now-chronic budget deficit, with the findings only increasing my sense of unease. Seth watched basketball at KeyArena. Audrey watched people cook and sew on TV. And Jeremy profiled Manifold Motion and the Satori Group, but not in a potential-terrorist way.

As the AP reported yesterday, the state is predicting "weak revenue" for the next year and a half (weak to the tune of $760 million), and so the deficit for that time period has grown to $2.6 billion. That said, Publicola is using $11.6 billion--the cumulative deficit amount for the state's budget from 2009 through 2011 so far--as a way of reminding everyone of how far we are from where budget forecasts started. (It's the same story as at the county and city budget level, writ large.)

With the series of cuts necessary to retire last year's $9-billion deficit, the state sliced past fat and into the meat of its social services. Much of the budget is mandatory, "protected" funding, so the legislature can only cut about one-third of the $33-billion biennial budget total. To make up the new $2.6 billion, Washington Budget & Policy Center says, the state would need to cut that one-third by about one-third.

With unemployment across the state at 9.3 percent (it's actually higher in Seattle), and projected to rise, not many people will greet the idea of higher taxes with delight. "The economic downturn has forced more than 60 percent of Puget Sound area residents to delay their retirement plans," says the PSBJ. If slumping consumer spending is driving most of the state's deficit, look for that to continue.

But taxes are what Democratic leadership is suggesting, though since they are looking for options that include their reelection, one likely suspect is sin taxes. Actually, higher liquor taxes prices just went into effect last August, when the Liquor Control Board raised its markup to just over 50 percent.

What we have here is both a failure of leadership and imagination. State and local government spending is hugely important to the economy--one study says that one lost government dollar equates to $1.41 in lost economic activity. Simply put, slashing government spending makes a recession worse, at precisely the time when people need government programs most.

Yet closing "tax loopholes" and soaking the remnants of our middle class isn't going to get the job done, either. I am a long way from knowing what the solution to this particular dilemma might be, but one thing is clear: The current plan--implementing destabilizing cuts in the hopes that the economy is "just taking a break" and will be back soon--is the option of people who have government jobs. And if things worsen, plenty of people now in Olympia may not have them.

(h/t to Belltownpeople)

The slogan for Belltown's Moda condominiums is "Fashionable living. With money left for life." There is not, apparently, money left to pay the subcontractors who installed the balconies.

Last Friday, Hideous Belltown was tipped off by a passer-by that men on a ladder were partially removing balconies from Moda. He inquired what they were up to, and they said they were owed $20,000 and were taking the balconies back.

Hideous Belltown's Keller took a walk by this week and it was true--the railings were gone from a number of balconies. The word is, the units of each are occupied, so there's a chance here for a particularly brave resident to--if he or she survives--to file a spectacular personal injury lawsuit.

Photo courtesy of Hideous Belltown/Igor Keller

Photo courtesy of Hideous Belltown/Igor Keller

Moda, unsurprisingly, did not return Hideous Belltown's call for comment.

Reading the IAM District 751 machinists union response to Boeing's North Charleston selection for its second 787 assembly line reminded me strongly of the dockworkers union in The Wire. President Tom Wroblewski, in his wounded outrage, talking about "betrayal," "loyalty," and a man's "word," summoned up shades of Frank Sobotka.

"We remain committed to the Puget Sound," said Jim Albaugh, president and CEO of Boeing's Commercial Airplanes division, giving "committed" a fairly capacious meaning that could soon include "My new phone number begins with area code (843)."

And state Senate Minority Leader Mike Hewitt (R-Walla Walla) said, "I think we could have enacted some of the reforms we needed last year," referring to reducing business costs in worker's compensation and unemployment insurance.

It's an education for everyone, which arrives, ironically, just as Boeing is cutting back on picking up its employees' lifetime-learning tab. Yesterday KIRO 7 asked whether this was the "first step in Boeing leaving the state."

It is hard to square any of these responses with Boeing having moved its corporate HQ to Chicago in 2001. For most of the decade, they have not even geographically been a hometown corporation that might be expected to "do right" by local workers, where management might share a personal "commitment" to the region, and were concerned simply with paying their fair share of taxes. They have been rent-seeking, to the evident detriment of their production line's timeliness...

Most Recent Comments