Since The SunBreak was founded, we have been telling you that Seattle Times columnist Jon Talton writes great stuff about the Puget Sound economy. (Partly we do this to keep him sane, beset as he is by Times comment-section trolls.) But today his work gets validation all the way across the country at Atlantic Cities, where Richard Florida quotes him in his post, “The Secret to Seattle’s Booming Downtown.”

But the area is in the midst of a true renaissance. As Jon Talton wrote earlier this week in the Seattle Times, downtown Seattle has not only recovered from its slump, it’s thriving. Amazon’s new headquarters could bring as many as 12,000 high-paid jobs to the area. The Bill and Melinda Gates foundation is opening a new campus. Even Boeing is leasing office space downtown.

Florida emailed Talton for more background, all featured in his Atlantic Cities post, but the upshot is this: “Today, Seattle provides a good example of the back-to-the-downtown trend that is reshaping cities across the United States as workers relocate to formerly neglected urban cores that offer transit, walkability, and central location.”

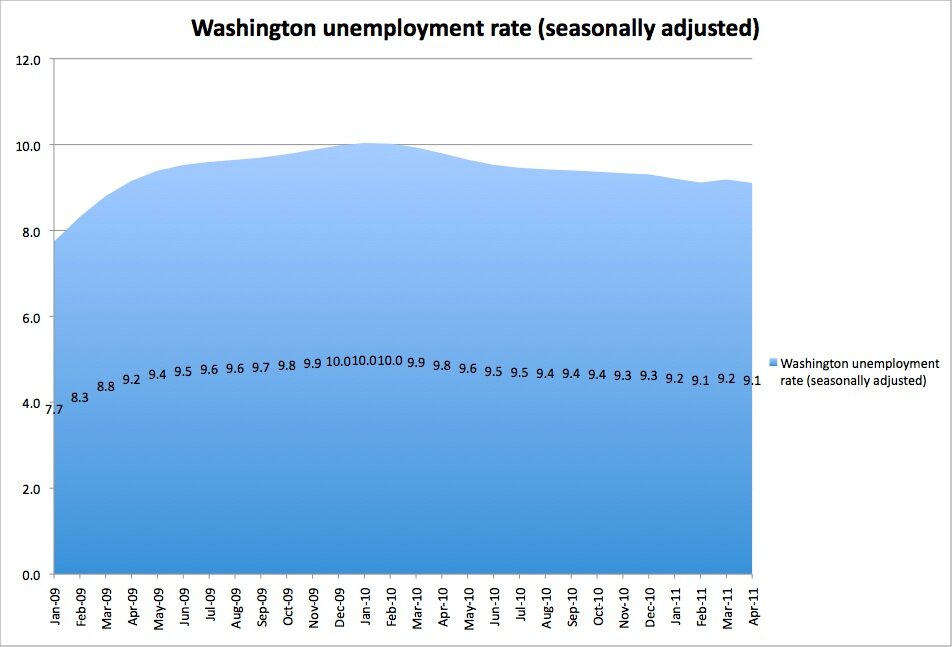

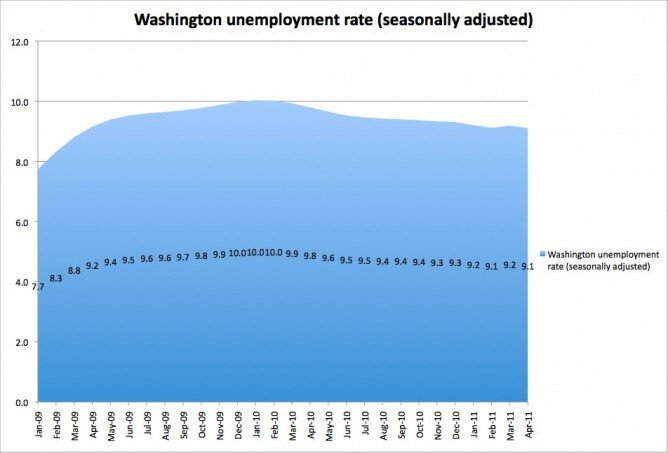

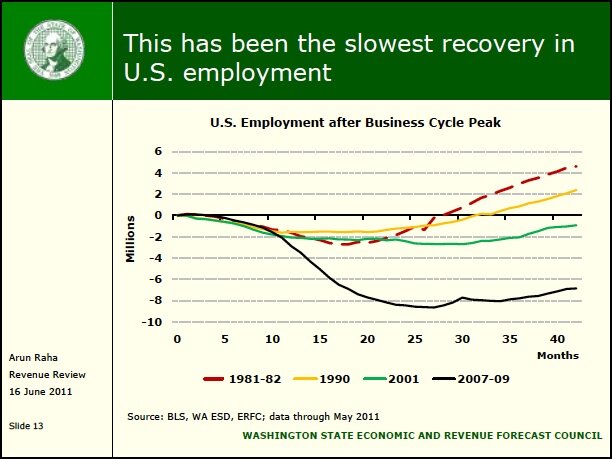

Florida, it’s safe to say, has a reputation for boosterism when it comes to promoting cities that appear to bolster his case for creative classification. But the signs are definitely pointing to a Seattle that’s poised to take advantage of post-Recession realities. As Geekwire noted recently, while the Washington State jobless rate’s dip, in February, to 8.2 percent was the lowest in three years, Seattle’s unemployment rate was even lower.

On Capitol Hill this week, a light-rail-tunnel-boring machine punched through on its trip from Montlake, leading CHS commenter oiseau to rhapsodize:

The area around Broadway Station is going to be the most convenient place to live in the entire city. A new subway station. A new tram stop. Two new rail lines. A wonderful cycle track. All of the amenities that we already have (restaurants, bars, grocery stores, pharmacies, etc etc etc) plus many more (permanent home for the famers’ market!).

Meanwhile, billionaire Paul Allen donated another $300 million toward brain science. In February, the state’s economic and revenue forecast council noted, “light motor vehicle (LMV) sales were one million units (SAAR) higher than January sales, coming in at 15.1 million units. This was the highest rate of sales since early 2008.”

Taken together, this does indeed sound like a recovery in progress. But, as Talton says, “Seattle has to keep the momentum going.” Two areas spring to my mind. One: the intersection of central waterfront planning and Seattle’s burgeoning cruise ship industry. “Disney’s decision to return to Vancouver next year is an economic loss for Seattle,” quoth the Seattle Times. Are we ready to talk about a higher-priced downtown cruise ship berth?

And, amid the excitement over light rail, there’s the news that King County Metro is gearing up to make a nearly-$240-million purchase of trolley buses. You don’t have to have much experience with Metro to suspect that the rider experience comes close to last in their calculations, a suspicion borne out by their response to my question about the new trolley bus interiors.

I emailed to inquire about “new interior features: e.g., configurable seating arrangements, cup holders, wifi, electronic displays, accessibility options, power outlets”–the kinds of things that Seattle’s new downtown residents might look for if transit is going to take the place of single occupancy vehicles. Randy Winders, Metro’s manager of vehicle maintenance, was kind of enough to respond, but the news was not heartening: “Exact interior amenities have not been determined. However, they will not have most of what is suggested [by your email].”

The notion that the insides of buses can be left to last has got to change. The inside, after all, is where the passengers are.